At an event in Beijing this week, the Chinese search giant Baidu announced a new version of its most capable language model, called Ernie 4.0. Baidu says the performance of this model matches that of the AI model behind ChatGPT. The company said it used tens of thousands of chips to train Ernie 4.0. It did not specify the type of chip that was used, but a source at the company, who asked to speak anonymously because they were not authorized to discuss the matter, confirmed that Nvidia chips were used.

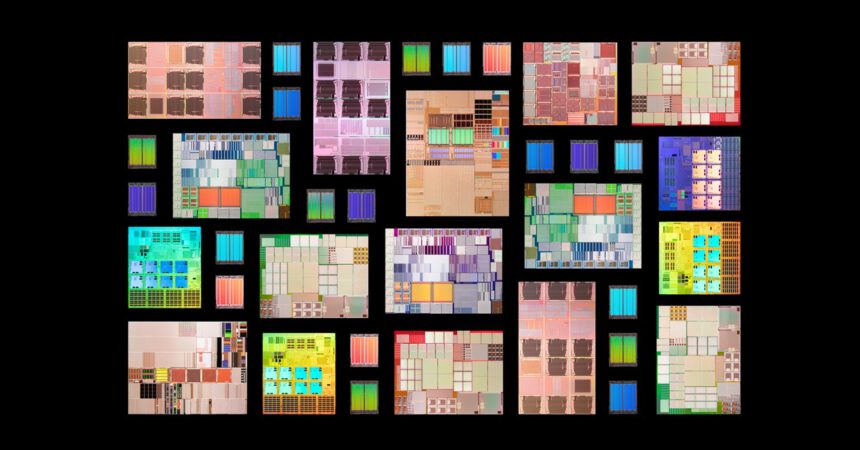

The new rules will bar companies from selling chips based on how fast they can compute and their power density, or the amount of processing power packed into a square area. The US government did not name the H800 chip, but it is widely seen as a target of the new controls.

Allen says that new restrictions on chipmaking equipment may be just as important as the tighter rules around sales of AI training chips. These rules will ban the sale of some equipment outright, whereas previous controls hinged on their end use, preventing Chinese companies from obtaining equipment by obscuring what they intended to do with it.

“These controls maintain our clear focus on military applications and confront the threats to our national security posed by the PRC government’s military-civil fusion strategy,” US secretary of commerce Gina Raimondo said in a statement issued by the Commerce Department’s Bureau of Industry and Security.

The government’s 2022 restrictions have proven controversial among US chipmakers, with some reportedly balking at the prospect of further controls.

The Semiconductor Industry Association, a body that represents US chip firms, issued a statement in response to the new restrictions that signaled its concern. “We recognize the need to protect national security and believe maintaining a healthy US semiconductor industry is an essential component to achieving that goal,” the statement reads. “Overly broad, unilateral controls risk harming the US semiconductor ecosystem without advancing national security as they encourage overseas customers to look elsewhere. Accordingly, we urge the administration to strengthen coordination with allies to ensure a level playing field for all companies.”

US chip restrictions may have helped boost China’s domestic chip industry, which is thought to lag behind that of the US, Taiwan, and South Korea by many years. In September, Huawei, a company that has been a particular target of US export controls, announced the Mate 60, a smartphone featuring a 7-nanometer chip manufactured by Semiconductor Manufacturing International Corporation, China’s most advanced chipmaker. The 7-nanometer manufacturing process is relatively advanced, suggesting that SMIC has made technical advances more rapidly than expected or has been able to skirt export controls.

The tighter controls also come at a tricky diplomatic moment, as the US government is seeking to improve relations with China. Members of the Biden administration have traveled to Beijing in recent months to meet with Chinese officials. President Biden may meet with the Chinese leader Xi Jinping at a meeting of Asia Pacific Economic Cooperation (APEC) members in San Francisco next month.

“The US needs to stop politicizing and weaponizing trade and tech issues and stop destabilizing global industrial and supply chain,” China’s Foreign Ministry spokesperson, Mao Ning, said yesterday in response to a question about the possible tightening of restrictions.

The US is unlikely to do that, says Chris Miller, an associate professor at Tufts University and the author of Chip War, a 2022 book about the geopolitical role of semiconductors. “The new rules explicitly list tech transfer to several of China’s own leading AI chip design firms,“ he says, and may be updated annually. „Tension“ over chips—and the AI capabilities they enable—is likely to remain at the center of China-US relations,” Miller says.